Introduction

Will AI Replace Financial Advisors? What Investors Need to Know. The rise of artificial intelligence (AI) has sparked a wave of disruption across almost every industry — finance being no exception. From robo-advisors managing portfolios to machine learning algorithms predicting market trends, the landscape of wealth management is evolving rapidly. But with this progress comes a pressing question: Will AI replace human financial advisors entirely?

The answer isn’t black and white. Instead, it lies in understanding what AI can do exceptionally well, what it still struggles with, and what investors actually need from a financial advisor.

Table of Contents

The Rise of AI in Financial Services

Over the last decade, AI tools have revolutionized how we approach money. Robo-advisors like Betterment, Wealthfront, and Schwab Intelligent Portfolios have made automated investing accessible and affordable for millions. These platforms offer:

- Algorithm-driven portfolio management

- Real-time risk assessment

- Tax-loss harvesting

- Automatic rebalancing

All of this, at a fraction of the cost of traditional financial advisors.

According to Statista, assets under management by robo-advisors are projected to reach $2.87 trillion by 2025 — a staggering figure that reflects growing trust in automated solutions. (Source)

But does that mean human advisors are on the way out? Not quite.

What AI Does Exceptionally Well

Let’s give credit where it’s due: AI is incredibly efficient at certain tasks. For example:

1. Data Analysis at Scale

AI can process massive volumes of financial data far faster than any human. It can identify patterns, anomalies, or opportunities based on real-time data, market trends, and even news headlines.

2. Removing Emotional Bias

Humans are emotional. We panic-sell during market dips or chase risky investments during rallies. AI, on the other hand, sticks to the plan — emotion-free and algorithm-driven.

3. Personalized Portfolio Allocation

Modern algorithms can customize portfolios based on your risk tolerance, investment goals, and time horizon — and adjust them dynamically.

What AI Still Can’t Do

Despite its strengths, AI has notable limitations — especially in areas where nuance, empathy, and complex human understanding are essential.

1. Life-Centered Financial Planning

Financial goals are rarely just about money. They’re about buying your first home, paying for your child’s education, or retiring in peace. A human advisor can talk to you about your life plans, your values, your fears — and help you build a financial roadmap that supports that vision.

AI may ask you if you’re risk-averse, but it won’t ask you how you feel about taking care of aging parents while planning for your own retirement.

2. Behavioral Coaching

A big part of an advisor’s job is helping clients stay the course. When markets crash, an app can’t talk you off the ledge — but a trusted advisor can.

3. Interpreting Complex Situations

Taxes, inheritance laws, business ownership transitions, real estate planning — these aren’t “plug and play” issues. They require human insight, often with experience across multiple financial domains.

The Hybrid Model: The Best of Both Worlds?

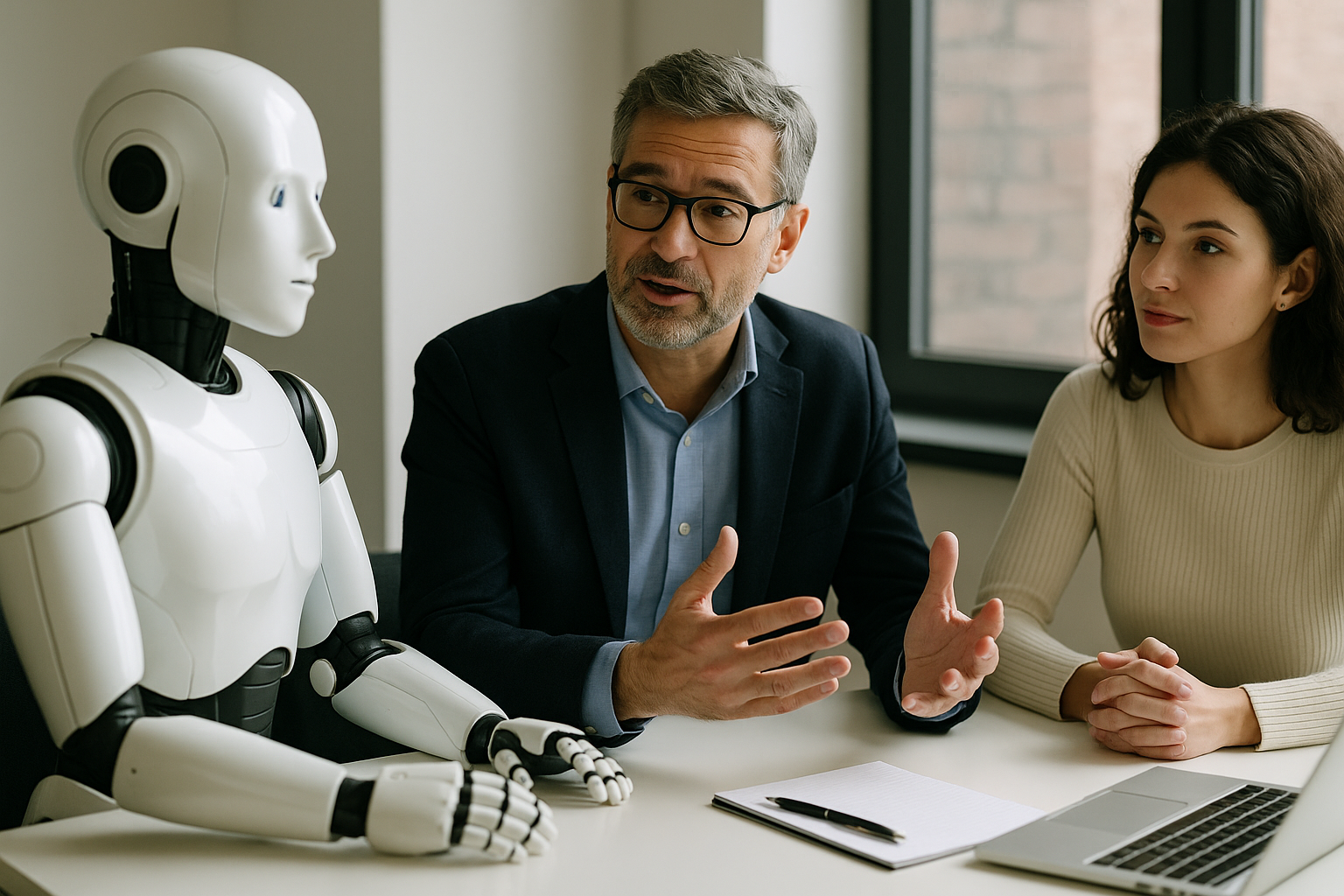

Instead of AI replacing advisors, what we’re seeing is a growing trend toward hybrid advisory models.

These combine the scalability of AI with the emotional intelligence and expertise of human advisors. Think of it this way:

AI handles the math, humans handle the meaning.

In fact, platforms like Vanguard Personal Advisor Services and Personal Capital have already integrated this approach, offering algorithm-based management along with access to certified advisors.

What Investors Should Consider

If you’re wondering whether to go fully digital or stick with a traditional advisor, here are some questions to guide you:

• Are your finances relatively simple?

If you’re young, saving for retirement, and just want a solid portfolio — robo-advisors can work just fine.

• Do you own a business, have dependents, or expect an inheritance?

In that case, you might benefit more from a human advisor who understands tax strategies, estate planning, and cash flow management.

• Do you panic during downturns?

A human advisor can provide emotional support and behavioral coaching, helping you make better long-term decisions.

The Cost Factor

One of the most compelling arguments for AI-driven advising is cost. Traditional financial advisors typically charge around 1% of assets under management annually. Robo-advisors? Just 0.25% to 0.40%.

But that gap narrows when you factor in value-added services like:

- Retirement planning

- Tax minimization strategies

- Business succession plans

- Insurance guidance

In many cases, paying a bit more for a human touch yields better results over the long haul.

Real-World Example

Let’s say you inherit $500,000. A robo-advisor might suggest investing it across a set of ETFs based on your age and risk tolerance.

But a human advisor might ask:

- Should you pay off your mortgage?

- What are the tax implications of inheritance in your state?

- Should you set up a trust for your children?

- Is there a charitable cause you care about?

The difference lies in context and conversation.

What the Future Holds

The financial advisory industry is not vanishing — it’s evolving.

- More advisors are adopting tech-enhanced tools.

- Clients expect more transparency and control, which digital tools provide.

- AI will continue to handle routine tasks, freeing human advisors to focus on what they do best — empathy, strategy, and guidance.

According to McKinsey, advisory firms that blend AI with human expertise see better client retention and improved profitability. (McKinsey on Wealth Management)

Conclusion: Replace or Reinvent?

AI isn’t here to replace financial advisors — it’s here to reinvent the way we interact with money and advice.

For investors, the key is to embrace both worlds:

- Use AI for what it excels at: automation, efficiency, cost savings.

- Trust human advisors for the emotional and strategic layers that AI can’t touch.

Ultimately, the smartest investors will be those who understand the power of technology — but don’t forget the value of human connection.

Final Thoughts

The future of finance isn’t man or machine. It’s man with machine.

As a next step, consider exploring hybrid services or speaking to an advisor who uses AI-enhanced tools. That way, you can enjoy the best of both innovation and insight.

Find more Finance content at:

https://allinsightlab.com/category/finance/