Introduction

Economic Value Added (EVA): Measuring True Performance. In today’s competitive business landscape, assessing a company’s true financial performance goes beyond traditional metrics like net income or earnings per share. One such advanced metric is Economic Value Added (EVA), which provides a clearer picture of value creation by considering the cost of capital.

Table of Contents

Understanding Economic Value Added (EVA)

Economic Value Added (EVA) is a financial performance measure that calculates the value a company generates beyond the required return on its invested capital. It reflects the true economic profit of a business by accounting for the cost of capital, providing a clearer picture of whether a company is creating or destroying shareholder value.

Components of EVA

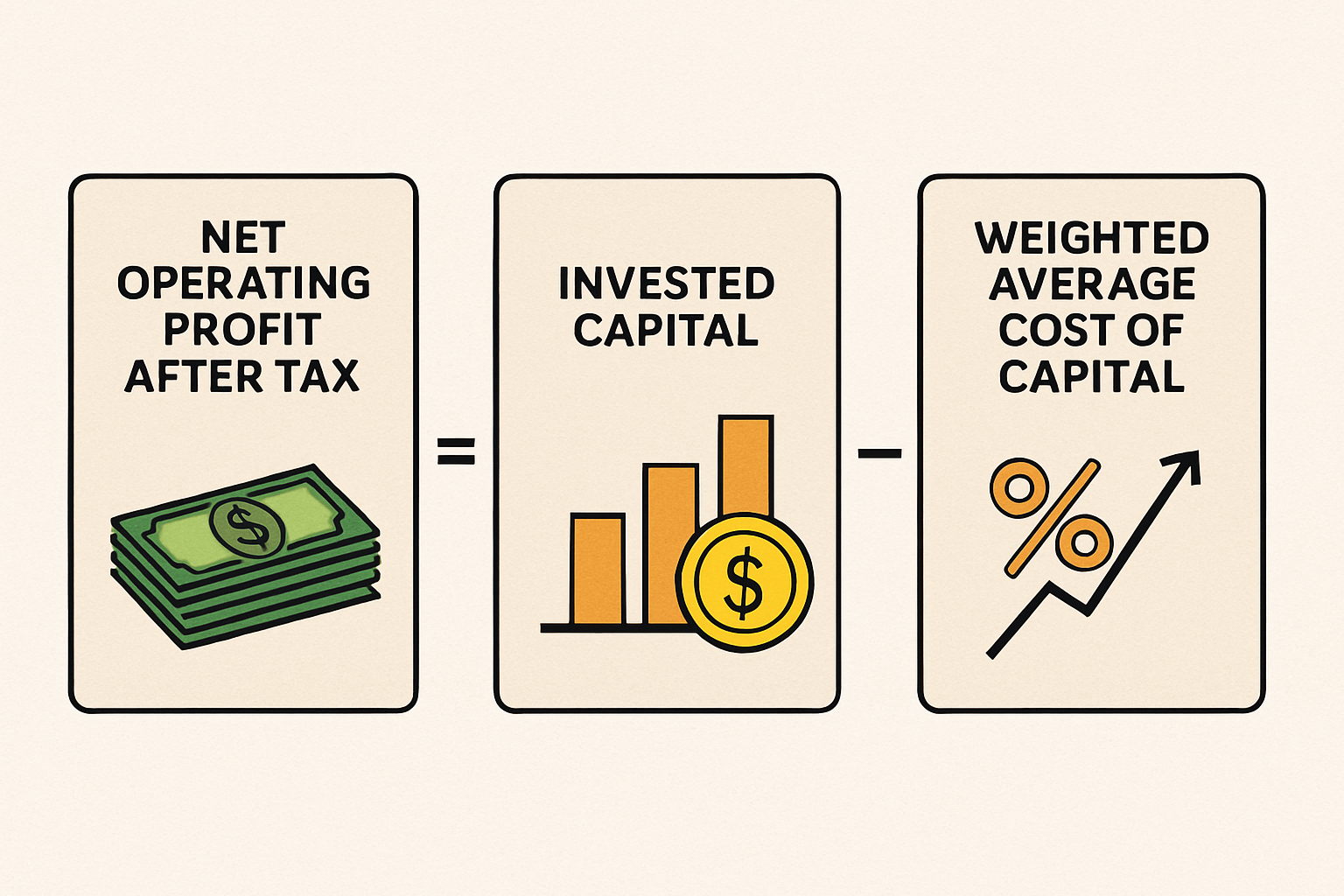

To understand EVA comprehensively, let’s break down its components:

1. Net Operating Profit After Tax (NOPAT)

NOPAT is derived from operating income, adjusted for taxes. It reflects the profitability of a company’s core operations without considering capital structure and interest expenses. Calculating NOPAT is crucial, as it serves as the starting point for determining EVA.

2. Invested Capital

Invested capital represents the total funds utilized in the business, which includes both equity and debt. Accurately assessing the amount of capital employed is essential for calculating the cost of capital.

3. Weighted Average Cost of Capital (WACC)

WACC is the average rate of return a company is expected to pay its investors (both debt and equity holders) for using their capital. It reflects the minimum return that a company must earn on its existing asset base to satisfy its investors.

Advantages of Using EVA

- Alignment with Shareholder Interests: EVA focuses on value creation, ensuring that management decisions are aligned with shareholder wealth maximization.

- Performance Measurement: It provides a clear measure of whether a company is generating returns above its cost of capital.

- Investment Decision-Making: EVA aids in evaluating the profitability of investment projects by considering the true cost of capital.

Limitations of EVA

- Complexity: Calculating EVA requires numerous adjustments to accounting figures, which can be complex and time-consuming.

- Not Suitable for All Industries: EVA may not be as effective for companies with significant intangible assets or those in rapidly changing industries.

- Short-Term Focus: EVA emphasizes current performance and may not fully capture long-term strategic initiatives.

Real-World Application: Nestlé’s EVA Analysis

To illustrate the practical application of EVA, let’s consider Nestlé’s financial performance. In a case study analyzing Nestlé’s EVA for the fiscal year 2018, the company demonstrated a positive EVA, indicating that it generated returns exceeding its cost of capital. This analysis underscores the utility of EVA in assessing corporate performance.

Conclusion

Economic Value Added (EVA) serves as a robust tool for measuring a company’s true economic profit by accounting for the cost of capital. While it offers valuable insights into value creation and performance measurement, it’s essential to consider its limitations and applicability to specific industries. Incorporating EVA into financial analysis can enhance decision-making and align management strategies with shareholder interests.

Note: For further reading on EVA and its applications, you may refer to the following resources:

- Investopedia: Economic Value Added (EVA)

- Corporate Finance Institute: Economic Value Added (EVA)

- Magnimetrics: Nestlé EVA Case Study

Find more Finance content at:

https://allinsightlab.com/category/finance/